|

|

09-02-2022, 05:38 PM

|

|

|

|

Join Date: Sep 2007

Location: Strathcona County

Posts: 1,896

|

|

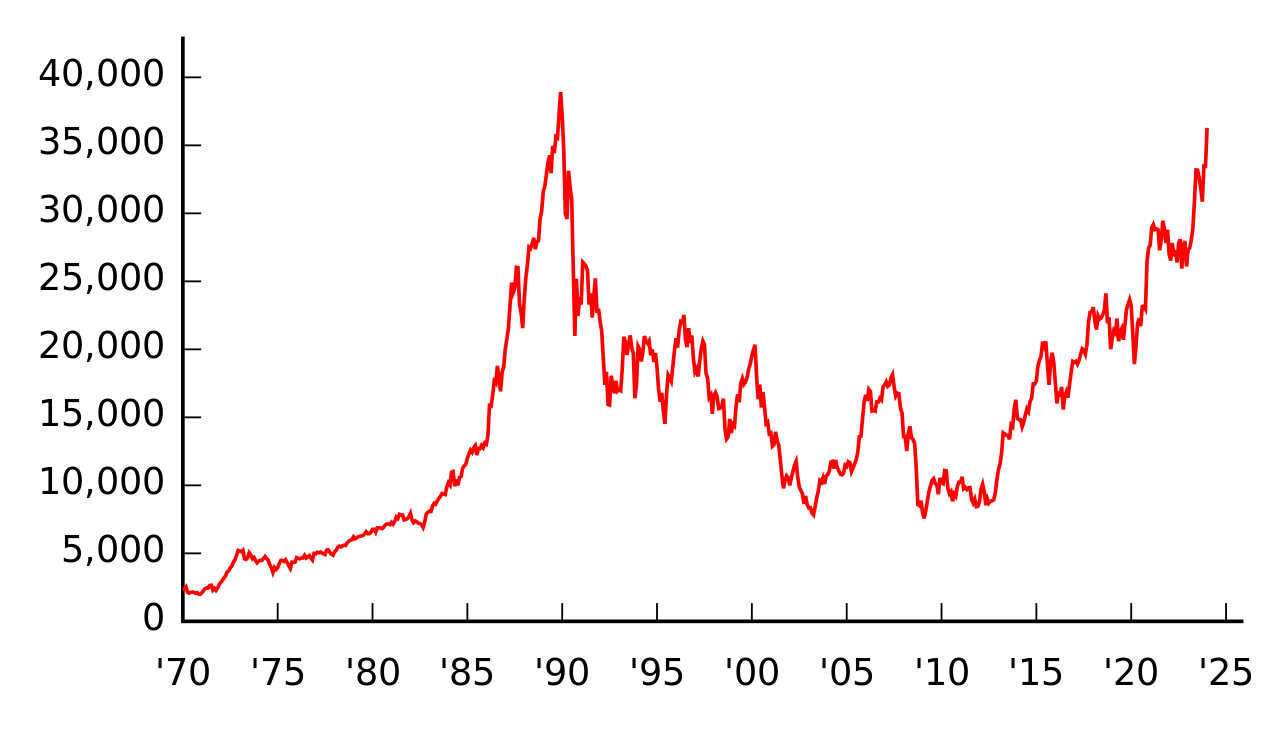

I don't know anyone that invests in the Nikkei on a regular basis nor do I live in Japan so that is more or less an irrelevant example.

|

09-02-2022, 10:10 PM

|

|

|

|

Join Date: Jul 2017

Posts: 3,701

|

|

Don’t think it is irrelevant at all, personally. Nikkei is a classic/extreme (of sorts) example, but it isn’t a far fetched scenario.

Here is a full picture, Nikkei and SP500:

|

09-03-2022, 09:33 AM

|

|

|

|

Join Date: Dec 2008

Location: Near Edmonton

Posts: 15,043

|

|

These last few posts illustrate a couple of things:

1) Dollar cost averaging works in all markets and it is one of the key reasons why re-investing dividends via the drip functions are such a critical part of the overall returns on these stocks

2) Market timing doesn't work. If you miss just a few of the major up days in a cycle you miss a ton of the up side

3) Even in the worst decades for stock market performance, if you buy quality stocks over that time you will still be up by large amounts over 30 years. Even in the example Fisherdan talks about, where you put in 12,000 in 1929 and only had a little over 7 by 1939, if you left that 7 invested it is now worth a few million.

4) Over concentration of your portfolio can be very detrimental - as in having 100% in Tech, or having put it all into the Japanese market 30 years ago.

5) If you buy and long term hold the wrong stocks you can get results from no increase to losing all of it. Chasing the current fad and hot ticket doesn't work.

6) If you don't know what the right stocks are and validate this through your own research, you are better off in broad market/sector ETFs than picking the wrong stuff.

A person can make a lot of money in the market, especially over 20-40 years, but it isn't just dead simple. You need to learn a lot about investing or learn a little and then you need a real good quality advisor. Both paths take a lot of work to either learn or to sift through advisors to find a good one. You should have a list of at least 6 skill testing questions you ask every advisor you are interviewing. A good one should be able to answer at least 5 off the top of his head.

For those that invest the time and effort, the rewards can be great with either approach.

|

09-03-2022, 09:52 AM

|

|

|

|

Join Date: Feb 2011

Location: Grande Prairie

Posts: 751

|

|

Quote:

Originally Posted by Dean2

These last few posts illustrate a couple of things:

1) Dollar cost averaging works in all markets and it is one of the key reasons why re-investing dividends via the drip functions are such a critical part of the overall returns on these stocks

2) Market timing doesn't work. If you miss just a few of the major up days in a cycle you miss a ton of the up side

3) Even in the worst decades for stock market performance, if you buy quality stocks over that time you will still be up by large amounts over 30 years. Even in the example Fisherdan talks about, where you put in 12,000 in 1929 and only had a little over 7 by 1939, if you left that 7 invested it is now worth a few million.

4) Over concentration of your portfolio can be very detrimental - as in having 100% in Tech, or having put it all into the Japanese market 30 years ago.

5) If you buy and long term hold the wrong stocks you can get results from no increase to losing all of it. Chasing the current fad and hot ticket doesn't work.

6) If you don't know what the right stocks are and validate this through your own research, you are better off in broad market/sector ETFs than picking the wrong stuff.

A person can make a lot of money in the market, especially over 20-40 years, but it isn't just dead simple. You need to learn a lot about investing or learn a little and then you need a real good quality advisor. Both paths take a lot of work to either learn or to sift through advisors to find a good one. You should have a list of at least 6 skill testing questions you ask every advisor you are interviewing. A good one should be able to answer at least 5 off the top of his head.

For those that invest the time and effort, the rewards can be great with either approach.

|

What type of skill testing questions do you ask a potential advisor?

|

09-03-2022, 10:35 AM

|

|

|

|

Join Date: Dec 2008

Location: Near Edmonton

Posts: 15,043

|

|

Quote:

Originally Posted by Outbound

What type of skill testing questions do you ask a potential advisor?

|

Funny you should ask that, I was just working on a list to post.  These are just some suggestions and options; you can of course tailor some of the questions or add more depending on your personal situation.

Skill testing and service level, cost questions to ask a potential advisor, or if you already have one, good way to assess what you have.

1. For Eligible Canadian Dividends, what is the dollar value of dividend income that I can earn basically tax free. Answer, approximately 50,000 per year in the absence of any other income.

2. How does a stock Drip program work. The monthly or quarterly dividend payments are re-invested automatically, no commissions are charged for the stocks bought with the dividends.

3. How can I make my mortgage interest tax deductible. Use your investments to pay off your mortgage, borrow the money against your house to buy those investments back. You make exactly the same payment at the same interest rate but the interest is tax deductible. The stocks are still unencumbered, as in not used for security, so you can sell them at any time to pay off the mortgage, subject to the early payout penalty, or for other uses. If you sell the investments down to below the mortgage loan value you will reduce the amount of interest that is deductible.

4. What is my Lifetime to date contribution limit for a TFSA. From 2009 till now 2022 $81,500. All dividends, interest and capital gains are not taxed, however capital loses are also not tax deductible.

5. Am I better off contributing to an RRSP or a TFSA. The answer to this is highly dependent on your current tax rate. You annual RRSP contribution limit builds up if you don’t deposit the money in that year so you are better off waiting until your marginal tax rate is above 35%. Below that you don’t maximize the available tax deduction and you could easily be paying tax on money you later withdraw from the RRSP at a tax rate higher than you were at when you took the deduction. Prior to that putting the money into a TFSA is generally better. Once your marginal tax rate gets to 35%+ you can borrow to use the accumulated contribution limit but the interest on that loan is not tax deductible. However, if you invest that contribution limit money every year into stocks outside an RRSP, you can sell them, put the money in RRSP and then borrow to buy back the stocks you sold and that loan interest is tax deductible.

The Canada Revenue Agency generally calculates your RRSP deduction limit as follows:

• your unused deduction room at the end of the preceding year

Plus

• The lesser of the two following items:

o 18% of your earned income in the previous year

o the annual RRSP limit (for 2021, the annual limit is $27,830)

• That exceeds one of the following items:

o your pension adjustments (PA)

o a prescribed amount

6. Can I setup more than 1 RESP for my child and can my parents set one up for them too. You can have as many as you like, but between all of them, including parents, grandparents etc, the annual/lifetime contribution limit is the same so you have to know what each is contributing in total.

Yearly and lifetime RESP contribution limits

From 1998 (the first year the program started) to 2006, inclusive:

• annual contribution limit: $4,000;

• lifetime contribution limit: $42,000 (including any contributions made prior to 1998).

From 2007 to present:

• no annual contribution limit;

• lifetime contribution limit: $50,000 (including all contributions made prior to 1998).

While there are currently no annual contribution limits, you can receive the Canada Education Savings Grant (CESG) only on the first $2,500 in contributions per year, or up to the first $5,000 in contributions, if sufficient carry forward room exists. Any contributions over and above these amounts will not receive any CESG for the current year or any subsequent years. All contributions exceeding $50,000 limit will not attract any grant even if the maximum $7,200 of grant is not reached.

Ask your RESP provider if your plan allows for transfers. Also, ask them to explain any conditions or penalties that may apply if you over-contribute to the account.

7. What fees do you charge, over and above any ETF, mutual fund or trading commissions? What are the portfolio dollar values at which the fee changes and do you have a list of those levels and rate?.

8. Any advisor fee above 1% of your portfolio value should come with a performance clause. Is your fee dependent on the performance you generate?

9. How often will you contact me during the year? Should be a minimum of 2X. What is your policy regarding contact frequency during market volatility?

10. Who else works on my account and what is the alternate contact if you are away? What is the process if you quit or are assigned to another portfolio of clients?

11. Approximately how large a book of business and how many clients do you currently manage? Any advisor with more than about 150 clients is not going to be giving you much personal attention.

|

09-03-2022, 03:47 PM

|

|

|

|

Join Date: Apr 2008

Posts: 1,484

|

|

What is a professional money managers responsibility to the firm he works for? To be a good salesman and attract people and their money into the door of the business. And when things don’t go well, their job is to say the right things to calm the people and keep them and their money at the firm. Let’s be honest, if they were any good at investing, they’d have made a bundle for themselves already and they wouldn’t be working a 9-5 at a frustrating, boring job. But…….. The vast majority of people are too lazy to put in the effort to educate themselves on how to make money efficiently in the markets themselves. So they hire “professionals”

|

09-03-2022, 03:55 PM

|

|

|

|

Join Date: Feb 2011

Location: Grande Prairie

Posts: 751

|

|

Quote:

Originally Posted by Dean2

Funny you should ask that, I was just working on a list to post.  These are just some suggestions and options; you can of course tailor some of the questions or add more depending on your personal situation.

Skill testing and service level, cost questions to ask a potential advisor, or if you already have one, good way to assess what you have.

1. For Eligible Canadian Dividends, what is the dollar value of dividend income that I can earn basically tax free. Answer, approximately 50,000 per year in the absence of any other income.

2. How does a stock Drip program work. The monthly or quarterly dividend payments are re-invested automatically, no commissions are charged for the stocks bought with the dividends.

3. How can I make my mortgage interest tax deductible. Use your investments to pay off your mortgage, borrow the money against your house to buy those investments back. You make exactly the same payment at the same interest rate but the interest is tax deductible. The stocks are still unencumbered, as in not used for security, so you can sell them at any time to pay off the mortgage, subject to the early payout penalty, or for other uses. If you sell the investments down to below the mortgage loan value you will reduce the amount of interest that is deductible.

4. What is my Lifetime to date contribution limit for a TFSA. From 2009 till now 2022 $81,500. All dividends, interest and capital gains are not taxed, however capital loses are also not tax deductible.

5. Am I better off contributing to an RRSP or a TFSA. The answer to this is highly dependent on your current tax rate. You annual RRSP contribution limit builds up if you don’t deposit the money in that year so you are better off waiting until your marginal tax rate is above 35%. Below that you don’t maximize the available tax deduction and you could easily be paying tax on money you later withdraw from the RRSP at a tax rate higher than you were at when you took the deduction. Prior to that putting the money into a TFSA is generally better. Once your marginal tax rate gets to 35%+ you can borrow to use the accumulated contribution limit but the interest on that loan is not tax deductible. However, if you invest that contribution limit money every year into stocks outside an RRSP, you can sell them, put the money in RRSP and then borrow to buy back the stocks you sold and that loan interest is tax deductible.

The Canada Revenue Agency generally calculates your RRSP deduction limit as follows:

• your unused deduction room at the end of the preceding year

Plus

• The lesser of the two following items:

o 18% of your earned income in the previous year

o the annual RRSP limit (for 2021, the annual limit is $27,830)

• That exceeds one of the following items:

o your pension adjustments (PA)

o a prescribed amount

6. Can I setup more than 1 RESP for my child and can my parents set one up for them too. You can have as many as you like, but between all of them, including parents, grandparents etc, the annual/lifetime contribution limit is the same so you have to know what each is contributing in total.

Yearly and lifetime RESP contribution limits

From 1998 (the first year the program started) to 2006, inclusive:

• annual contribution limit: $4,000;

• lifetime contribution limit: $42,000 (including any contributions made prior to 1998).

From 2007 to present:

• no annual contribution limit;

• lifetime contribution limit: $50,000 (including all contributions made prior to 1998).

While there are currently no annual contribution limits, you can receive the Canada Education Savings Grant (CESG) only on the first $2,500 in contributions per year, or up to the first $5,000 in contributions, if sufficient carry forward room exists. Any contributions over and above these amounts will not receive any CESG for the current year or any subsequent years. All contributions exceeding $50,000 limit will not attract any grant even if the maximum $7,200 of grant is not reached.

Ask your RESP provider if your plan allows for transfers. Also, ask them to explain any conditions or penalties that may apply if you over-contribute to the account.

7. What fees do you charge, over and above any ETF, mutual fund or trading commissions? What are the portfolio dollar values at which the fee changes and do you have a list of those levels and rate?.

8. Any advisor fee above 1% of your portfolio value should come with a performance clause. Is your fee dependent on the performance you generate?

9. How often will you contact me during the year? Should be a minimum of 2X. What is your policy regarding contact frequency during market volatility?

10. Who else works on my account and what is the alternate contact if you are away? What is the process if you quit or are assigned to another portfolio of clients?

11. Approximately how large a book of business and how many clients do you currently manage? Any advisor with more than about 150 clients is not going to be giving you much personal attention. |

That's a good list, thanks! Saved it for when I have enough money to need to hire an advisor.

|

09-03-2022, 04:57 PM

|

|

|

|

Join Date: May 2007

Location: Red Deer

Posts: 1,531

|

|

Quote:

Originally Posted by eric2381

What is a professional money managers responsibility to the firm he works for? To be a good salesman and attract people and their money into the door of the business. And when things don’t go well, their job is to say the right things to calm the people and keep them and their money at the firm. Let’s be honest, if they were any good at investing, they’d have made a bundle for themselves already and they wouldn’t be working a 9-5 at a frustrating, boring job. But…….. The vast majority of people are too lazy to put in the effort to educate themselves on how to make money efficiently in the markets themselves. So they hire “professionals”

|

I saw it first hand on an elderly’s account who had no idea about investments.

They take all your money and have it all invested, but they buy stocks that they already own.

Then they buy and sell constantly so you never see any big drops that would get you scared.

They buy $1000 of each stock and have up to 40 stocks in one account.

Then if the market is down 10% for the year, your account makes +5%. But if the market is up by +25% , you make 5%.

Oh and their fees will exactly equal the dividends.

But if the market collapses, your SOL.

|

09-04-2022, 09:24 AM

|

|

|

|

Join Date: Apr 2008

Posts: 1,484

|

|

I do have a question, please and thanks.

How does a guy go about buying and possibly selling Canada and US government treasury bonds, in the future?? It’s one aspect I’m not sure about and I’d sure appreciate some info from people who have done it.

Thanks for your time. I appreciate it.

|

09-04-2022, 09:30 AM

|

|

|

|

Join Date: Dec 2008

Location: Near Edmonton

Posts: 15,043

|

|

Quote:

Originally Posted by eric2381

I do have a question, please and thanks.

How does a guy go about buying and possibly selling Canada and US government treasury bonds, in the future?? It’s one aspect I’m not sure about and I’d sure appreciate some info from people who have done it.

Thanks for your time. I appreciate it.

|

If you have a self trading account with any broker, TD, Qtrade, Royal etc, you can buy them direct in there just like a stock or mutual fund. Usually has a heading under the Buy and Sell section called "Fixed Income" or something similar. You can also buy GICs, Corporate debt the same way. Call in to your service line and have them walk you through the first buy, after that you will be comfortable buying them online on your own. Renumber, they sell at NPV and the fees for buying and selling can be quite a lot higher than you pay for stocks so it pays to negotiate spreads and fees.

This is what the Fixed Income looks like at RBC. You can see search, has T-Bills, GIC, Bonds etc for choices.

I will add one thing, like every profession, some Advisors are not good at what they do, but there are also a ton of well trained, dedicated, very good people working in the business. As to, if they were any good they would have made a ton and retired, not accurate. No matter how good you are it takes at least 20 years to make a ton, unless you get really lucky and went all in and hit a ten or twenty bagger, and that isn't the guy you want running your portfolio.

Yes, do the work to find a good one, just like with contractors, trades, auto repair, restaurants and everything else but don't paint a whole industry with the same brush. I see that done regularly on AO with Realtors, Lawyers, Cops etc. Usually reflects a very deep lack of knowledge about what they are actually talking about and a lack of willingness to truly understand the complexities of the issues. Easier to spout off than learn. Try not to be one of those people.

Last edited by Dean2; 09-04-2022 at 09:56 AM.

|

09-04-2022, 10:17 AM

|

|

|

|

Join Date: Apr 2008

Posts: 1,484

|

|

Thanks a lot Dean for the info.

As to my comment about advisors and “professionals”, I stand by what I said and that’s from experience and learning. Some people do “get lucky”, but people that know what they’re doing don’t “get lucky”. They wait for the perfect opportunity and when they can see it and know it thru their knowledge and experience , they go for it with no fear because they know the risk.

|

09-04-2022, 10:21 AM

|

|

|

|

Join Date: Apr 2008

Posts: 1,484

|

|

Do you know if those govt bonds can also be sold on the same platform? I am with RBC like you are. Thanks

|

09-04-2022, 10:25 AM

|

|

|

|

Join Date: Apr 2008

Posts: 1,484

|

|

I know US treasury bonds can be bought at Treasurydirect.gov

|

09-04-2022, 02:48 PM

|

|

|

|

Join Date: Jul 2017

Posts: 3,701

|

|

|

09-05-2022, 03:09 PM

|

|

|

|

Join Date: Jan 2010

Posts: 2,999

|

|

Quote:

Originally Posted by fishnguy

|

Guess he choose the wrong block to pull out.... or too slippery of a bath rug to step on.

|

09-05-2022, 10:00 PM

|

|

|

|

Join Date: Jan 2014

Location: Edmonton

Posts: 5,612

|

|

Quote:

Originally Posted by fishnguy

|

Did he know something about Clintons? Or Maxwell?

|

09-06-2022, 10:08 AM

|

|

|

|

Join Date: Dec 2008

Location: Near Edmonton

Posts: 15,043

|

|

Have been watching NVIDIA just out of interest since KGB was talking about them. They are down to $136, from a high of $347 in the last 12 months and from $195 Aug 4th. The stock chart is demonstrating an ongoing down trend with lower highs and lower lows. Next support level is at $73 from pre Feb 2020, so this could easily drop a long ways yet. There have also been export controls to China and Russia just introduced on ALL chip makers so that isn't going to help either. Does not bode well for NVIDIA, the other chip makers or a lot of the Tech market in general. I believe we are a long ways from capitulation in the Tech sector.

|

09-06-2022, 10:35 AM

|

|

|

|

Join Date: May 2007

Posts: 3,953

|

|

Quote:

Originally Posted by Dean2

Have been watching NVIDIA just out of interest since KGB was talking about them. They are down to $136, from a high of $347 in the last 12 months and from $195 Aug 4th. The stock chart is demonstrating an ongoing down trend with lower highs and lower lows. Next support level is at $73 from pre Feb 2020, so this could easily drop a long ways yet. There have also been export controls to China and Russia just introduced on ALL chip makers so that isn't going to help either. Does not bode well for NVIDIA, the other chip makers or a lot of the Tech market in general. I believe we are a long ways from capitulation in the Tech sector.

|

Where's Robin Hood when you need them!

But as for the China Syndrome with chip supply chain, the Co claims it has a bright future.

As for the earlier post about in house management of investments selling stocks that the House already has, AND BOND FUNDS they already have, sort of like CIBC does with Investors Edge, I wish it was a lie. Why would a company buy bonds in a managed house fund when there is no return?

Drewski

|

09-06-2022, 12:19 PM

|

|

|

|

Join Date: Dec 2008

Location: Near Edmonton

Posts: 15,043

|

|

I have had a few people ask me about CWB given the recent large drop in their share price and the fact they are trading at a large discount to their peers.. Here are my thoughts.

CWB is primarily a commercial lender, they have only a very small retail book. Commercial lending will always be more risky than mortgage or retail lending. If 100% of the portfolio was mortgages, at least 60% would be insured, meaning the Bank suffers zero loss on delfault. On the remaining 40%, to be uninsured the borrower had to put down at least 25%. Until house prices drop more than 25% from what the mortgaged house was bought at, not necessarily the most recent highs, the bank is still fully secured. Even if house prices drop 40%, only about 3% of mortgages go into foreclosure per year during large downturns, so still very limited loss exposure. Most commercial loans have very little realizable security on them. When they go under, the Bank typically gets 10 to 20 cents on the dollar for the security.

Now, all that said, I don't think CWB is in any danger of going broke. They are badly run, but that is in comparison to some of the best run Banks in the World like TD and RBC. If CWB gets down to 21 or 22 bucks, I will pick some up for a short term hold and re-sell but this is not a long term hold opportunity given the much better choices.

There is a long list of stocks that trade below their peers, Suncor, Manulife, Laurentian Bank, and on it goes. They have for years and there is a good reason they trade at a discount - performance and poor management. I always buy the best managed in any sector, in Banks that is RY, TD and for a smaller one National. CWB's results speak for themselves, I never bet against demonstrated performance.

|

09-07-2022, 08:15 AM

|

|

|

|

Join Date: May 2010

Location: edmonton

Posts: 3,846

|

|

Bank of Canada hike 75 points for September

Bank of Canada hike 75 points for September

Btc drop pass the $19000usd it’s been trying to hold the $20k . Looks like gold Is treading water trying to stay above the 1700 usd as well .

Last edited by fishtank; 09-07-2022 at 08:21 AM.

|

09-07-2022, 09:15 AM

|

|

|

|

Join Date: May 2007

Location: Red Deer

Posts: 1,531

|

|

Interest rates up to 3.25%

Alberta pays back 13B in debt.

I like the way things are headed.

|

09-07-2022, 11:55 AM

|

|

|

|

Join Date: Dec 2008

Location: Near Edmonton

Posts: 15,043

|

|

Have a read through this. Guy is a frequent guest and "Expert" on BNN. Read the market outlook bit. Think about the part I bolded and put in Red. Then look at the performance of his previous top picks Yep, this is just the guy I want investing my money, STRONG NOT!!!!. A properly constructed portfolio, from Sept 2021 to Sept 2022 is still up 13%, not down 52% like his top picks.

Worst part is there are lots of people that listen to these guys and take their crap advice. ALWAYS do your own research, watching BNN is NOT research.

Kim Bolton MARKET OUTLOOK:

Inflation has been the number one topic in the U.S. economy for all of 2022, and it's the reason consumer sentiment has moved down to levels really only seen at the depths of recessions or bear market lows. The U.S. Fed kept its benchmark interest rate at zero as y/y CPI crept above 5 per cent, then 6 per cent, then 7 per cent, and it wasn't until CPI crossed 8 per cent that the first hike occurred in March. We've seen y/y CPI remain above 8 per cent since then, and the Fed has responded with back-to-back 75-basis-point hikes to get the Fed Funds Rate up to the current 2.25-2.5 per cent range with another 50 to 75 basis points (bps) of tightening expected later this month.

Aside from last month's jobs report, we've seen a steady number of disinflationary readings over the last month or two. Last month's CPI number actually showed a slight m/m decline, and another flat reading is currently expected for the August number that's due out in a couple of weeks. Barring another big spike in costs that would go against everything we've seen recently, we think a range of 0.0 per cent to 0.4 per cent for m/m headline CPI over the next year is reasonable. If CPI were to remain unchanged and stay at 0.0 per cent m/m, we would see y/y CPI quickly fall to 3 per cent by next March, and it would be down to 1.36 per cent y/y by next May.

If we saw a constant 0.1 per cent m/m move going forward, we'd see y/y CPI down in the 2-3 per cent range by next May. A 0.2 per cent m/m move for CPI would cause the y/y reading to dip to 2.2 per cent by next June, while a 0.3 per cent m/m reading gets y/y CPI down to 3.3 per cent by June.

What this means is that while y/y CPI remains sky-high right now, barring any big surprises, we could see it get back down in the 2-4 per cent range sometime next spring or summer. At the same time, current Fed Funds Futures pricing has the Fed Funds Rate projected to be just under 4 per cent from next March through July when y/y CPI could easily already be back down in the 2-3 per cent range. Earlier this year, we heard a lot of talk that we've never seen inflation come back down from such elevated levels without the Fed hiking rates above y/y CPI. This could happen by next spring without the Fed having to hike past 4 per cent. Chair Powell and Co. have certainly done plenty of hawkish jawboning lately, but as long as m/m inflation readings stay around or below 0.3 per cent over the next 6-9 months (which we think is a reasonable expectation based on recent data), y/y CPI will be back down to more normal levels and actually below where futures pricing projects the Fed Funds Rate to be.

With the stock market a forward-looking mechanism, we'd expect it to start acting more positively than it has lately if we see this type of path for CPI play out. That is if it's not also projecting an economy that's going to be significantly weaker than it is now. It's hard to argue that the recent pullback since mid-August has been anything other than Fed/inflation driven given how much Treasury yields have spiked. A stock market falling due to weaker economic expectations should coincide with lower Treasury yields instead of the higher yields we've seen over the last few weeks.

Your Black Swan Dexteritas [BSD] portfolio management team is very constructive on the stock market’s performance for the remainder of 2022. The markets will need major participation from its largest sector – the technology sector – when this rebound starts to unfold.

We remain confident our portfolio management tools can generate annualized returns in excess of 8 per cent for the BSD Fund, and achieve the performance expectations of our customized Separately Managed Account clients.

TOP PICKS:

Kim Bolton's Top Picks

Kim Bolton, president and portfolio manager of Black Swan Dexteritas, discusses his top picks: Atlassian Corporation PLC, Mastercard, and SAP SE.

Atlassian (TEAM NASD)

TEAM is a software company that provides solutions to enhance productivity within technical and business teams. The company’s product offerings can be broadly divided into 3 areas – project management and support; collaboration; and software development lifecycle tools. Importantly, TEAM's tools do not solve specific technical problems, but rather help teams work more closely together. They have had excellent traction among developer teams, the company’s primary market. Meanwhile, IT support teams also represent a fast-growing opportunity, and TEAM has begun selling into business teams (i.e. outside of tech) as well.

TEAM’s unique GTM approach will enable it to further disrupt the market for issue and project tracking developer tools. JIRA Software has a near-dominant competitive position and plenty of growth ahead. Rapid JIRA Service Desk growth will continue, with significant share gains. And while in the early days, our analysis shows that even minimal information worker penetration for TEAM’s Trello and JIRA Core products will be a needle mover for the company. We expect to see material longer-term operating leverage as the company continues to scale and move further upmarket.

Fiscal F4Q22 Results: TEAM reported a strong quarter with revenue of $759.8M (+36 y/y) besting consensus by 5 per cent and coming in well above management's guide for $710M - $725M. Subscription revenue led the beat and was driven by sustained momentum in Cloud (+55 per cent y/y) and strong Data Center demand (+60 per cent). A strong cloud net expansion rate of 130 per cent (140 per cent for large customers) was a key contributor to cloud growth while a step down in loyalty discounts in both Cloud and Data Center offerings (starting July 1) also contributed to the outperformance. TEAM grew its customer base by 8,048 net adds, consistent with 3Q's 8,054.

Mastercard (MA NYSE)

Mastercard Incorporated, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. It facilitates the processing of payment transactions, including authorization, clearing, and settlement, as well as delivers other payment-related products and services.

Mastercard put up solid results, comfortably beating consensus and assuaging fears of a consumer spending in the near term. In addition, Mastercard expects continued improvements in cross border volumes, particularly in travel

Guidance: In terms of forward-looking commentary, management indicated that they generally expect a modest improvement in cross-border travel vs 2019 levels as well as resilient consumer spending for 2H 2022. On rebates and incentives, MA noted that the mix has not yet returned to historical levels, particularly on cross-border, and the company expects to see some benefit of that come through rebates and incentives.

Looking ahead, while macro concerns around consumer spending remain, we continue to view Mastercard as well positioned given the remaining leverage to the recovery in cross border and the internal hedge of higher inflation vs lower consumer spending

SAP SE (SAP NYSE)

SAP operates as an enterprise application software company worldwide.

The company operates through three segments: Applications, Technology & Support; Qualtrics; and Services. It offers SAP S/4HANA, an ERP suite with intelligent technologies, such as artificial intelligence, machine learning, and advanced analytics

SAP SuccessFactors Human Experience Management provides cloud-based solutions, such as a human resources management system for core HR and payroll, talent management, employee experience management, and people analytics; and intelligent spend management solutions, including products branded under the SAP Ariba, SAP Concur, and SAP Fieldglass names.

The company also provides SAP customer experience solutions; SAP Business Technology platform that enables customers and partners to extend and customize SAP applications in a cloud-native way; and SAP Business Network that enables companies to extend their ecosystem, react to supply chain disruptions, discover new trading partners, and find new opportunities.

We believe SAP has a diversified cloud portfolio that is likely to show resilience during a macro downturn given its product breadth and ability to drive efficiencies for its customers. Management also noted that it can flex costs as in prior downturns and highlighted scope of saving in the triple digit millions.

SAP lowered its 2022 adjusted profit outlook to between 7.6 billion and 7.9 billion euros, from a range of 7.8 billion to 8.25 billion euros. SAP, however, affirmed its revenue outlook.

PAST PICKS: October 20, 2021

Kim Bolton's Past Picks

Kim Bolton, president and portfolio manager of Black Swan Dexteritas, discusses his past picks: Monday.com, Taiwan Semiconductor, and Global-e Online.

Monday.com (MNDY NASD)

Then: $367.63

Now: $111.84

Return: -70%

Total Return: -70%

Taiwan Semiconductor (TSM NYSE)

Then: $115.59

Now: $79.20

Return: -31%

Total Return: -30%

Global-e Online (GLBE NASD)

Then: $64.85

Now: $29.41

Return: -55%

Total Return: -55%

Total Return Average: -52%

Last edited by Dean2; 09-07-2022 at 12:04 PM.

|

09-07-2022, 01:33 PM

|

|

|

|

Join Date: Apr 2008

Posts: 1,484

|

|

Great thoughts and info Dean. Thanks.

ZIM is up to 82% dividend now. I’ve just been watching it for curiosity

|

09-07-2022, 01:36 PM

|

|

|

|

Join Date: Apr 2008

Posts: 1,484

|

|

Motley Fool. YouTube videos. BNN. Etc etc etc. Are not where you want to be filling your mind with ideas from.

|

09-07-2022, 01:46 PM

|

|

|

|

Join Date: Dec 2008

Location: Near Edmonton

Posts: 15,043

|

|

Quote:

Originally Posted by eric2381

Great thoughts and info Dean. Thanks.

ZIM is up to 82% dividend now. I’ve just been watching it for curiosity

|

Yes, but only because the share price has basically dropped in half in less than 30 days.  They also have not announced what the amount of the next dividend will be, could come out anywhere from zero on up.

|

09-07-2022, 01:54 PM

|

|

|

|

Join Date: May 2010

Location: edmonton

Posts: 3,846

|

|

Quote:

Originally Posted by Dean2

Yes, but only because the share price has basically dropped in half in less than 30 days.  They also have not announced what the amount of the next dividend will be, could come out anywhere from zero on up. |

Yes most stock seem drop equivalent % of the dividend after the ex date , same here after Aug 26 it’s been dropping . Most would recovered between the next dividends , but some don’t .

|

09-07-2022, 01:56 PM

|

|

|

|

Join Date: May 2007

Location: Red Deer

Posts: 1,531

|

|

Quote:

Originally Posted by Dean2

Yes, but only because the share price has basically dropped in half in less than 30 days.  They also have not announced what the amount of the next dividend will be, could come out anywhere from zero on up. |

Its getting closer to my buy in price.

I know accountants that can polish a turd to look like gold though with quarterly reports.

|

09-07-2022, 02:27 PM

|

|

|

|

Join Date: Apr 2008

Posts: 1,484

|

|

Quote:

Originally Posted by Dean2

Yes, but only because the share price has basically dropped in half in less than 30 days.  They also have not announced what the amount of the next dividend will be, could come out anywhere from zero on up. |

Yes for sure. I was just updating

|

09-07-2022, 07:21 PM

|

|

|

|

Join Date: Aug 2012

Location: Calgary

Posts: 346

|

|

Thanks Dean for all the posts and information. That BNN is something else. That's all my dad watches. That's all my best friends mom watches too. I think there are a lot of older boomers who's window to the outside world is through BNN.

On another note, oil sure got punched in the mouth today. I guess there is a good chance that it will keep slowly sliding down until after the midterms.

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 06:50 PM.

|