|

02-20-2018, 10:50 PM

|

|

Moderator

|

|

Join Date: Feb 2015

Posts: 7,642

|

|

Canadian Stock Market

Canadian Stock Market

Yet another reason I'm not to fond of the current government:

Link

"Canada’s market is not only bad; it’s the absolute worst performing market in the world. Okay, we’re leaving Venezuela off the list, but among the 106 global markets tracked by Bloomberg, we are number 105."

|

02-20-2018, 10:57 PM

|

|

Banned

|

|

Join Date: Jun 2009

Posts: 1,779

|

|

Quote:

Originally Posted by Trochu

Yet another reason I'm not to fond of the current government:

Link

"Canada’s market is not only bad; it’s the absolute worst performing market in the world. Okay, we’re leaving Venezuela off the list, but among the 106 global markets tracked by Bloomberg, we are number 105." |

What would you have the current government do about this exactly? I saw an awful lot of people with good ideas head south over the past couple decades because trying to find investors for anything but energy here was next to impossible.

How does the government fix that?

|

02-20-2018, 11:01 PM

|

|

|

|

Join Date: Dec 2008

Location: Camrose

Posts: 45,111

|

|

Quote:

Originally Posted by midgetwaiter

What would you have the current government do about this exactly? I saw an awful lot of people with good ideas head south over the past couple decades because trying to find investors for anything but energy here was next to impossible.

How does the government fix that?

|

Start by looking at the taxation system. Let the people that are wiling to invest in our country keep more of their earnings.

__________________

Only accurate guns are interesting.

|

02-21-2018, 12:00 AM

|

|

Banned

|

|

Join Date: Jun 2009

Posts: 1,779

|

|

Quote:

Originally Posted by elkhunter11

Start by looking at the taxation system. Let the people that are wiling to invest in our country keep more of their earnings.

|

How does that address the issue discussed in the article? Please explain how lowering personal taxes would result in a change to the companies that compose the TSXC. Be specific.

|

02-21-2018, 12:39 AM

|

|

|

|

Join Date: Jun 2012

Posts: 398

|

|

perhaps if we doubled the taxation the markets would improve.

|

02-21-2018, 06:06 AM

|

|

|

|

Join Date: Nov 2008

Posts: 11,348

|

|

Canadian market is doing poorly because it is heavily oil and gas based. If those recover so will the Canadian markets. There are stocks within the Canadian market doing very well, but they are based in other sectors.

__________________

“One of the sad signs of our times is that we have demonized those who produce, subsidized those who refuse to produce, and canonized those who complain.”

Thomas Sowell

|

02-21-2018, 06:18 AM

|

|

Gone Hunting

|

|

Join Date: Feb 2009

Location: Lougheed,Ab.

Posts: 12,736

|

|

Quote:

Originally Posted by pikergolf

Canadian market is doing poorly because it is heavily oil and gas based. If those recover so will the Canadian markets. There are stocks within the Canadian market doing very well, but they are based in other sectors.

|

...and why are the energy stocks in the toilet???

__________________

The future ain't what it used to be - Yogi Berra

|

02-21-2018, 06:19 AM

|

|

|

|

Join Date: Nov 2008

Posts: 11,348

|

|

Quote:

Originally Posted by hal53

...and why are the energy stocks in the toilet???

|

Price of oil???

__________________

“One of the sad signs of our times is that we have demonized those who produce, subsidized those who refuse to produce, and canonized those who complain.”

Thomas Sowell

|

02-21-2018, 06:23 AM

|

|

Gone Hunting

|

|

Join Date: Feb 2009

Location: Lougheed,Ab.

Posts: 12,736

|

|

Quote:

Originally Posted by pikergolf

Price of oil???

|

wrong.....

__________________

The future ain't what it used to be - Yogi Berra

|

02-21-2018, 06:26 AM

|

|

|

|

Join Date: Jun 2011

Posts: 3,713

|

|

If you have been blindly investing in the TSX through a market tracking ETF it hasn't been a great few years. Certain sectors and companies have done well however. Canadian domiciled companies that do a good portion of their business internationally is where I look for Canadian exposure. With the improvement in oil and commodities it's starting to look more interesting here though. Buy low, sell high.

__________________

There are some who can live without wild things, and some who cannot. Aldo Leopold

|

02-21-2018, 06:28 AM

|

|

|

|

Join Date: Nov 2008

Posts: 11,348

|

|

Quote:

Originally Posted by hal53

wrong.....

|

You are right, the price of oil has nothing to do with how well an oil company does.

__________________

“One of the sad signs of our times is that we have demonized those who produce, subsidized those who refuse to produce, and canonized those who complain.”

Thomas Sowell

|

02-21-2018, 06:30 AM

|

|

Gone Hunting

|

|

Join Date: Feb 2009

Location: Lougheed,Ab.

Posts: 12,736

|

|

Quote:

Originally Posted by pikergolf

You are right, the price of oil has nothing to do with how well an oil company does.  |

There is nothing wrong with the world price of oil, WTI and Brent Crude are doing well......but thanks for your comment..

__________________

The future ain't what it used to be - Yogi Berra

|

02-21-2018, 06:33 AM

|

|

|

|

Join Date: Nov 2008

Posts: 11,348

|

|

Quote:

Originally Posted by hal53

There is nothing wrong with the world price of oil, WTI and Brent Crude are doing well......but thanks for your comment..  |

And yet US oil company stocks are down as well, weird.

__________________

“One of the sad signs of our times is that we have demonized those who produce, subsidized those who refuse to produce, and canonized those who complain.”

Thomas Sowell

|

02-21-2018, 06:35 AM

|

|

Gone Hunting

|

|

Join Date: Feb 2009

Location: Lougheed,Ab.

Posts: 12,736

|

|

Quote:

Originally Posted by pikergolf

And yet US oil company stocks are down as well, weird.

|

Yeah, tough to figure that one out eh?

__________________

The future ain't what it used to be - Yogi Berra

|

02-21-2018, 07:11 AM

|

|

Moderator

|

|

Join Date: Feb 2015

Posts: 7,642

|

|

Quote:

Originally Posted by midgetwaiter

What would you have the current government do about this exactly? I saw an awful lot of people with good ideas head south over the past couple decades because trying to find investors for anything but energy here was next to impossible.

How does the government fix that?

|

Diversify the economy by providing corporate tax incentives, make it attractive to business via any means possible really but taxes are the big one, maybe take some of that $8.5 million for an outdoor hockey rink, $850 million to Syria, or $650 million earmarked for "sexual and reproductive health and rights worldwide" and invest it into Canadians. As for the current market, I'm sure a simple pipeline would do wonders for the Canadian discount.

|

02-21-2018, 07:19 AM

|

|

|

|

Join Date: Dec 2012

Location: Airdrie

Posts: 1,490

|

|

Quote:

Originally Posted by hal53

wrong.....

|

Please provide us with a little more information. This little back and forth you have going does nothing.

|

02-21-2018, 08:33 AM

|

|

|

|

Join Date: Sep 2014

Posts: 262

|

|

What does the current government have to do with that, the article took a timeline from 08-09 till current times. That means 70% of the blame should be going to the conservatives.

Additionally by your reasoning that the political party in power is fully in control of the market gyrations, wouldn’t the conservatives be to blame for the entire recession that we have spent the last decade struggling to recover from?

More factors at play than party policy and government missteps.

|

02-21-2018, 08:36 AM

|

|

|

|

Join Date: Dec 2008

Location: Camrose

Posts: 45,111

|

|

Quote:

Originally Posted by midgetwaiter

How does that address the issue discussed in the article? Please explain how lowering personal taxes would result in a change to the companies that compose the TSXC. Be specific.

|

Where did I specify personal taxes? I am referring to all taxation, which includes tax breaks for companies that provide employment in Canada.

__________________

Only accurate guns are interesting.

|

02-21-2018, 08:42 AM

|

|

Banned

|

|

Join Date: Jun 2009

Posts: 1,779

|

|

Quote:

Originally Posted by Trochu

Diversify the economy by providing corporate tax incentives, make it attractive to business via any means possible really but taxes are the big one, maybe take some of that $8.5 million for an outdoor hockey rink, $850 million to Syria, or $650 million earmarked for "sexual and reproductive health and rights worldwide" and invest it into Canadians. As for the current market, I'm sure a simple pipeline would do wonders for the Canadian discount.

|

Did you read the article YOU linked? Do you understand what the S&P/TSX Conposite Index is? Here’s what the article has to say:

Here in Canada, the economy is strong and pretty good when it comes to diversification, too. Not so the Canadian stock market, which is why we are all acutely feeling the painful effects of a bear market in energy and why this would be a great time to think about whether you’re getting enough diversification from your holdings.

The point they are trying to make is that there are too many energy companies in the index. This has nothing at all to do with anything but the index itself. If you want to take issue with the way the government is managing the economy or argue for any of the points you just raised that’s great but using this information to support those arguments makes no sense. It’s like trying to say that Ford pickups are the best because you have three bananas on your pocket.

|

02-21-2018, 08:43 AM

|

|

Banned

|

|

Join Date: Jun 2009

Posts: 1,779

|

|

Quote:

Originally Posted by elkhunter11

Where did I specify personal taxes? I am referring to all taxation, which includes tax breaks for companies that provide employment in Canada.

|

Which would impact the list of companies that comprise the index how exactly?

|

02-21-2018, 10:12 AM

|

|

Moderator

|

|

Join Date: Feb 2015

Posts: 7,642

|

|

Quote:

Originally Posted by midgetwaiter

Did you read the article YOU linked? Do you understand what the S&P/TSX Conposite Index is? Here’s what the article has to say:

Here in Canada, the economy is strong and pretty good when it comes to diversification, too. Not so the Canadian stock market, which is why we are all acutely feeling the painful effects of a bear market in energy and why this would be a great time to think about whether you’re getting enough diversification from your holdings.

The point they are trying to make is that there are too many energy companies in the index. This has nothing at all to do with anything but the index itself. If you want to take issue with the way the government is managing the economy or argue for any of the points you just raised that’s great but using this information to support those arguments makes no sense. It’s like trying to say that Ford pickups are the best because you have three bananas on your pocket.

|

And diversifying the economy and getting non-energy companies in the index, which I was posting about, is completely unrelated somehow....

|

02-21-2018, 10:30 AM

|

|

|

|

Join Date: Jun 2008

Location: Ft. McMurray and Kingston

Posts: 1,764

|

|

After a heart-to-heart talk with my financial adviser yesterday we are moving significant funds out of Canadian markets. No choice, our retirement funds and plans are in increasing jeopardy if we stay in Canadian  .

Personally I'd rather stay in Canadian markets (patriotic tendencies), but .....

My financial guy (headquartered in the Toronto area) lays much of the blame on our current Federal gov't and it's policies, and the BOC gov. His view, bolstered by most of his financial colleagues, is that things are going to get worse for Canada over the next few years unless gov't and BOC reverse course (little likelihood of that happening). They are seeing companies and investment fleeing Canada in droves!

Take that as you all will  .

|

02-21-2018, 12:40 PM

|

|

|

|

Join Date: May 2007

Location: Red Deer

Posts: 1,531

|

|

Well you should have a head to head convo with your broker but...

So you see Canada getting worse for the next couple years even though the tsx was just at an all time high last month?

Or did you think stock market in canada has been doing bad since the feds changed hats?

I would like to hear which world economy your stock broker says is at a low and is really looking good for next couple years.

Im just a dumb personal investor but i make money every year and wouldnt think of moving my money outside canada.

Potash, banks, rail, reits, minerals will all will be pushing foward in canada.

|

02-21-2018, 12:43 PM

|

|

|

|

Join Date: May 2010

Location: edmonton

Posts: 3,843

|

|

land locked resource ...single market to the usa .

|

02-21-2018, 02:17 PM

|

|

|

|

Join Date: May 2007

Location: South West Alberta

Posts: 804

|

|

We have a landlocked oil issue. Canada is screwing itself. Pipeline, rail and trucking stocks are doing okay shipping crude at a discount to our only customer the USA. It is probably better to own US oil stocks that buys our crude at a 25 to 30% discount refines it and sells it to the world at full price. No point in selling Canadian energy stock until we kick out the NDP and Liberals. Until the political environment improves and is business friendly more money will leave Canada than stay.

|

02-21-2018, 02:39 PM

|

|

Banned

|

|

Join Date: Jun 2009

Posts: 1,779

|

|

Quote:

Originally Posted by Trochu

And diversifying the economy and getting non-energy companies in the index, which I was posting about, is completely unrelated somehow....  |

Largely unrelated yes. The S&P/TSX index is an artificial construct composed of companies that are important to the TSE. There is no guarantee or requirement that it reflects Canadian economy. In fact one of the points made by the article is that it doesn't.

|

02-21-2018, 06:43 PM

|

|

|

|

Join Date: Oct 2012

Posts: 4,032

|

|

Don't be such Debbie-Downers..the stockmarket will balance itself,

it's not complicated, it's trudeau economics.

Last edited by tri777; 02-21-2018 at 06:55 PM.

|

02-22-2018, 03:19 PM

|

|

Banned

|

|

Join Date: Jun 2009

Posts: 1,779

|

|

Quote:

Originally Posted by midgetwaiter

Largely unrelated yes. The S&P/TSX index is an artificial construct composed of companies that are important to the TSE. There is no guarantee or requirement that it reflects Canadian economy. In fact one of the points made by the article is that it doesn't.

|

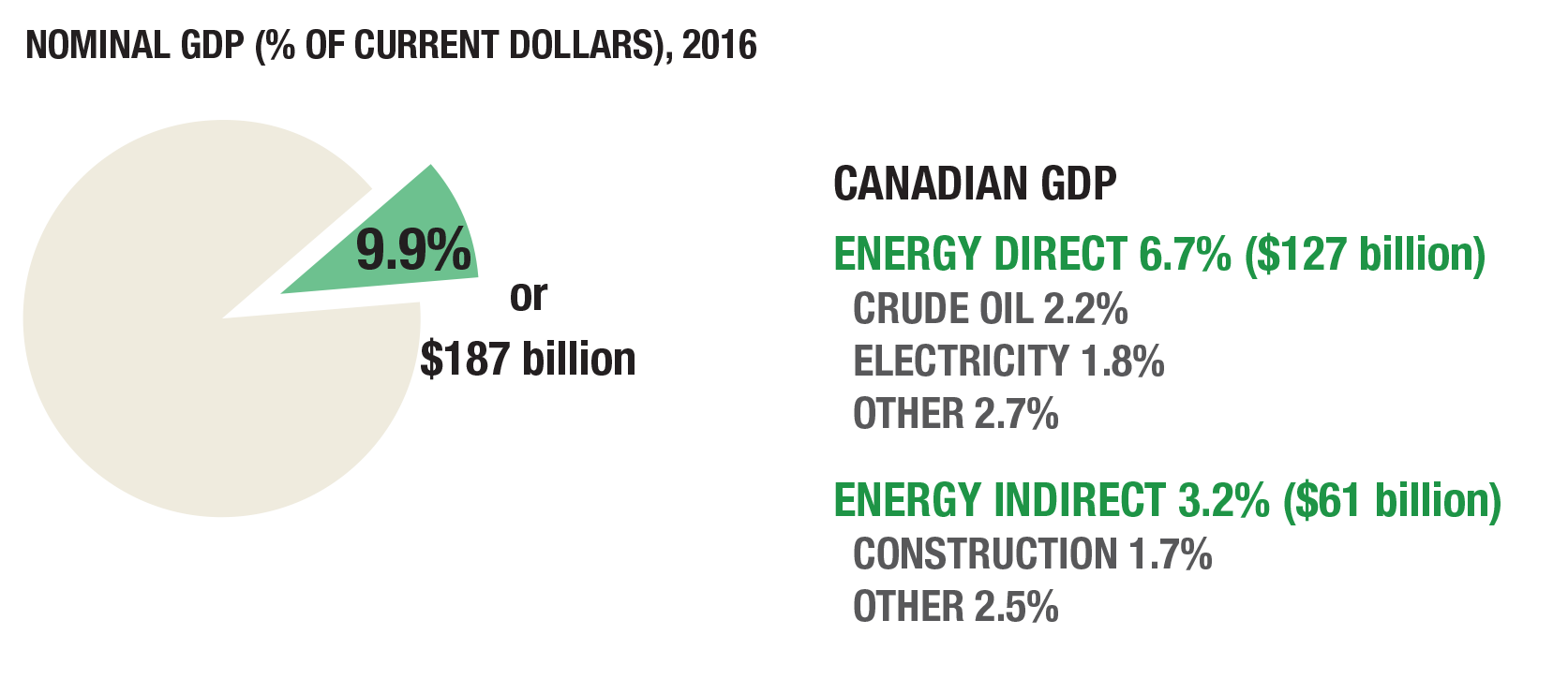

Here's the numbers in case anyone is interested.

Energy sector as a percentage of GDP from NRCAN (2016)

If you look at S&P's site the current sector breakdown lists Energy at 18.9%

https://us.spindices.com/indices/equ...omposite-index

Diversifying the economy is a good thing but it won't automatically diversify the SPTSX along with

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 10:06 PM.

|